Taiwan Panel Producer Results – October

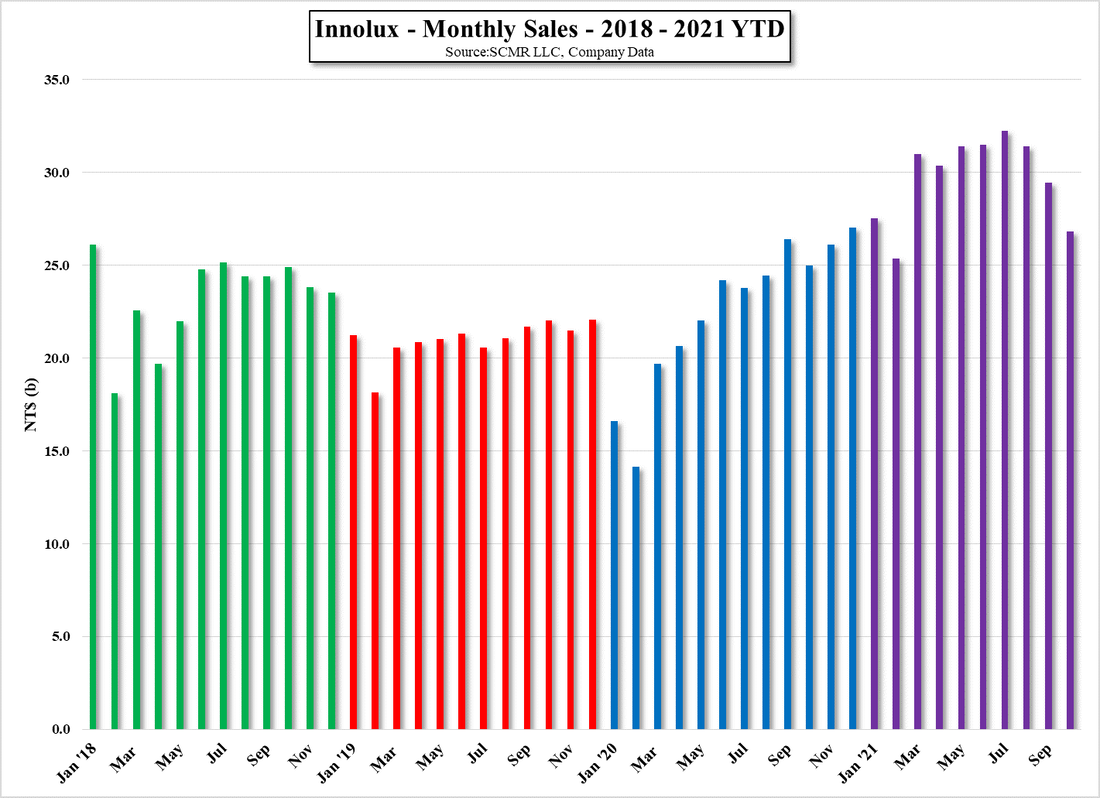

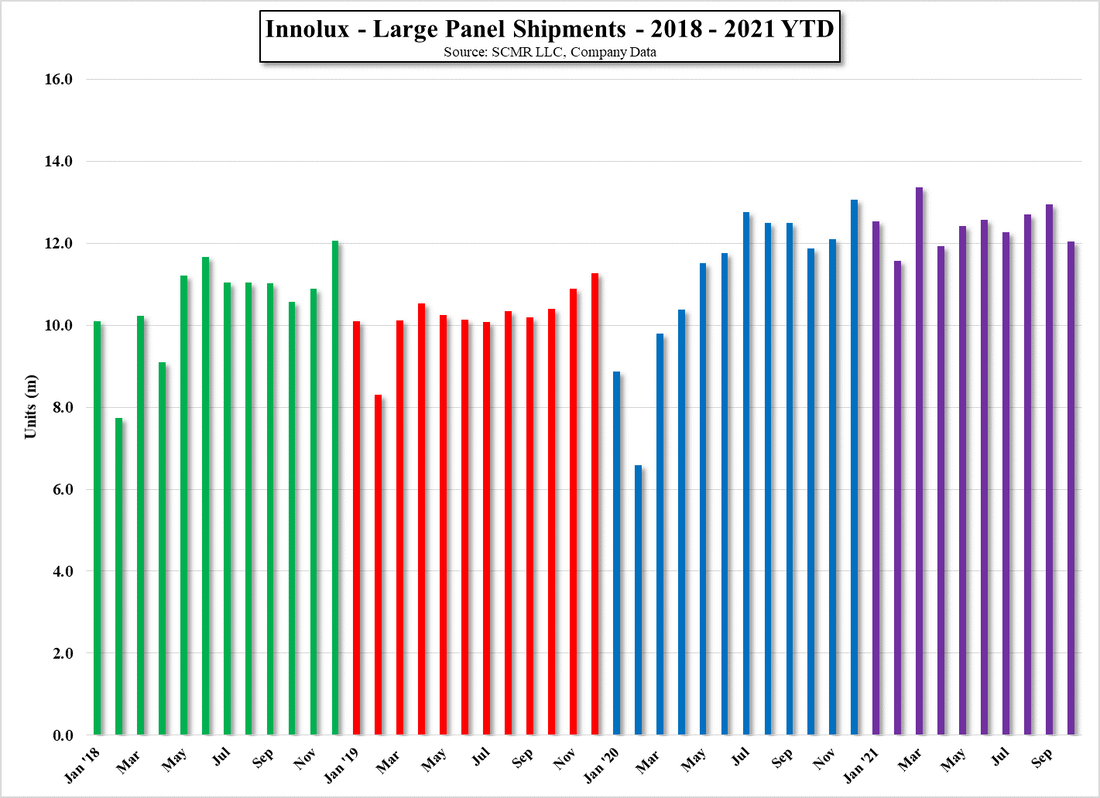

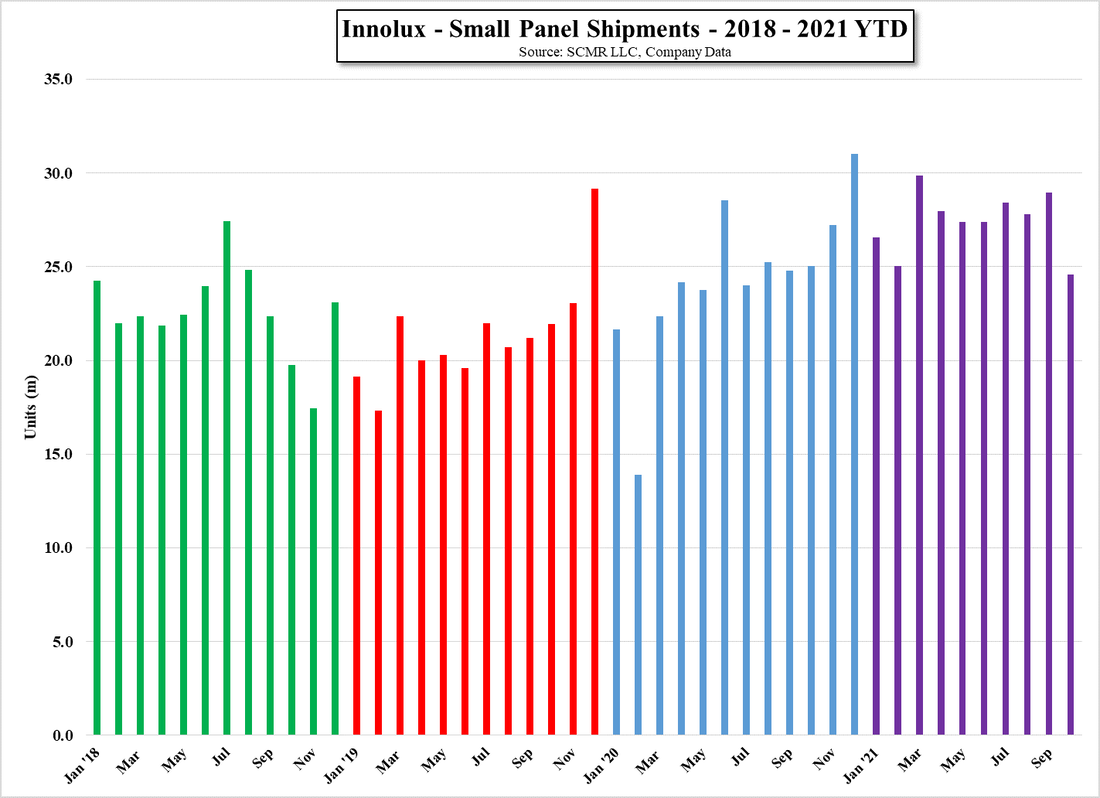

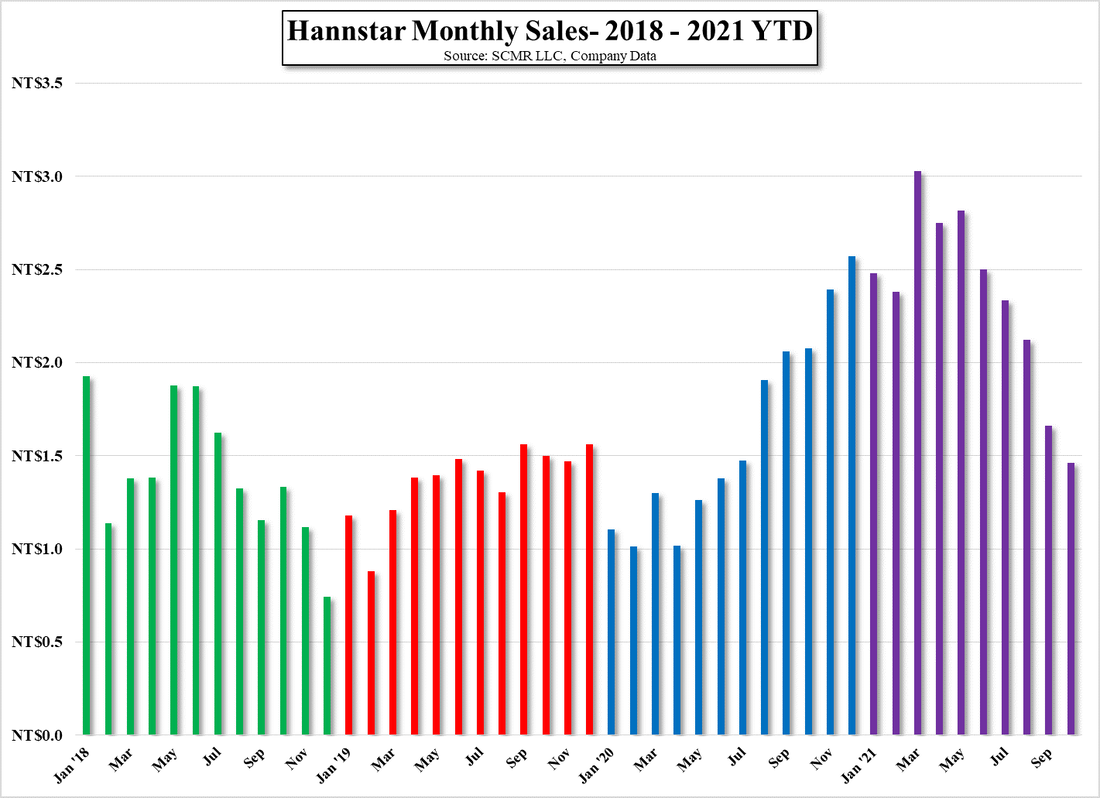

Innolux (3481.TT) has less wiggle room on a y/y sales basis, but relatively consistent large panel shipments have helped to maintain positive y/y monthly sales, however small panel shipments dropped to a yearly low in October, which will impact profitability as small panels are the most profitable on a m2 basis. Hannstar (6116.TT), which is focused on small panel production, saw a continuation of sales declines that began after a peak in small panel production back in March as smartphone demand continues to wane. We would not expect much change until production for the next smartphone cycle resumes in March 2022.

RSS Feed

RSS Feed